Delve into the world of auto insurance quotations with this comprehensive guide. From decoding complex insurance jargon to unraveling the factors that impact your premiums, this guide has you covered. Get ready to navigate the intricate landscape of auto insurance like a pro.

Understanding Auto Insurance Quotations

Auto insurance quotations refer to the estimated prices provided by insurance companies for coverage based on the information provided by the policyholder. These quotes Artikel the cost of the premium and the coverage details.

Importance of Comparing Multiple Quotations

It is crucial to compare multiple auto insurance quotations to ensure that you are getting the best coverage at a competitive price. By comparing quotes from different providers, you can identify the most cost-effective option that meets your needs.

Factors Influencing Auto Insurance Quotations

- Your driving record: A history of accidents or traffic violations can increase your insurance premium.

- Type of coverage: The level of coverage you choose, such as liability, comprehensive, or collision, will impact the cost of your insurance.

- Vehicle make and model: The age, make, and model of your vehicle can affect your insurance premium.

- Location: The area where you live and park your car can influence the cost of your insurance.

Tips for Interpreting and Analyzing Insurance Quotations

- Understand the coverage: Make sure you understand what is included in each quotation and the level of protection it offers.

- Compare deductibles: Evaluate the deductibles for each quotation to determine how much you would pay out of pocket in the event of a claim.

- Check for discounts: Look for any discounts or incentives offered by insurance companies that could lower your premium.

- Review additional coverage options: Consider add-ons like roadside assistance or rental car coverage and determine if they are worth the extra cost.

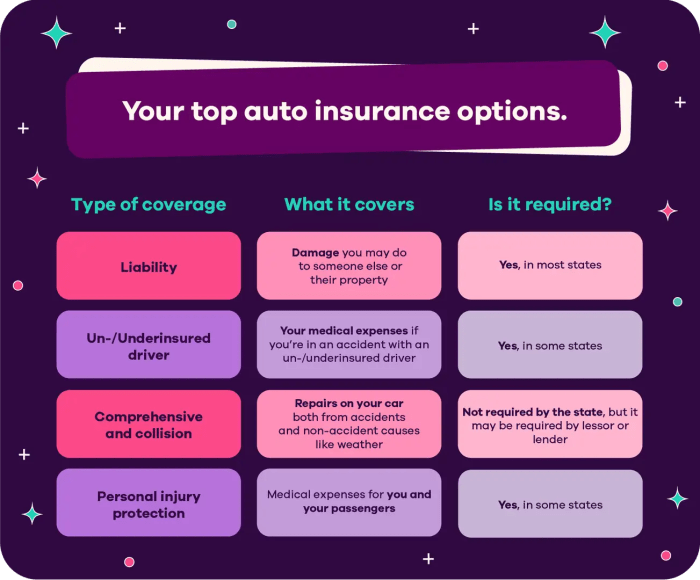

Types of Auto Insurance Coverage

When it comes to auto insurance, there are several types of coverage included in insurance quotations that provide protection in different scenarios. Understanding these types of coverage is crucial for making informed decisions about your insurance policy.

Liability Coverage

Liability coverage is a fundamental component of auto insurance that covers costs related to injuries or property damage to others in an accident where you are at fault. This coverage helps pay for medical expenses, legal fees, and repair costs for the other party involved in the accident.

Collision Coverage

Collision coverage is designed to cover the costs of repairing or replacing your vehicle in the event of a collision with another vehicle or object. This type of coverage is especially beneficial if you have a newer or more valuable car that you want to protect in case of an accident.

Comprehensive Coverage

Comprehensive coverage provides protection for your vehicle against non-collision incidents such as theft, vandalism, natural disasters, or hitting an animal. This type of coverage is essential for safeguarding your car from unexpected events that are beyond your control.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage steps in to cover your medical expenses and damages if you are involved in an accident with a driver who has insufficient or no insurance. This type of coverage ensures that you are not left with hefty bills in case the at-fault driver cannot cover the costs.

Medical Payments Coverage

Medical payments coverage helps pay for medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. This coverage can be beneficial in covering medical bills that may not be fully covered by your health insurance.

Rental Reimbursement Coverage

Rental reimbursement coverage provides compensation for the cost of renting a vehicle while your car is being repaired due to a covered claim. This coverage can be useful in ensuring you have a temporary means of transportation during repairs.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage is similar to medical payments coverage but may also cover lost wages and other expenses related to injuries sustained in an accident. This type of coverage varies by state but can provide additional financial support in the aftermath of an accident.

Factors Affecting Auto Insurance Quotations

When it comes to calculating auto insurance quotations, several key factors come into play

Personal Details Impact on Insurance Costs

- Your Age: Younger drivers are typically charged higher premiums due to their lack of driving experience and statistically higher likelihood of accidents.

- Driving Record: A clean driving record with no traffic violations or accidents can lead to lower insurance costs, while a history of accidents or traffic tickets may result in higher premiums.

- Location: Where you live can impact your insurance rates, with urban areas generally having higher rates due to increased traffic congestion and likelihood of theft or vandalism.

Vehicle Make, Model, and Usage

- Vehicle Make and Model: The type of car you drive plays a significant role in determining your insurance premiums. Expensive or high-performance vehicles may cost more to insure due to their repair costs and increased risk of theft.

- Vehicle Usage: How you use your vehicle, such as for commuting, business purposes, or leisure, can also affect your insurance rates. Vehicles used for commercial purposes typically have higher premiums.

Comparing Auto Insurance Quotations

When obtaining auto insurance quotations, it is essential to compare them effectively to make an informed decision. By analyzing the different aspects of each quotation, you can determine which one offers the best coverage at a reasonable price.

Checklist of Essential Elements to Look For

- Coverage Limits: Compare the coverage limits offered by each quotation to ensure they meet your needs and state requirements.

- Deductibles: Check the deductibles for comprehensive and collision coverage, as higher deductibles can lower your premium.

- Add-Ons: Evaluate any additional coverages or add-ons included in the quotations, such as roadside assistance or rental car reimbursement.

- Discounts: Look for any available discounts, such as safe driver discounts or multi-policy discounts, that can help lower your premium.

- Exclusions: Review the exclusions listed in each quotation to understand what is not covered under the policy.

Strategies for Negotiating Better Rates

- Use the Information Gathered: Utilize the information from the quotations to negotiate with insurance providers for better rates.

- Ask for Discounts: Inquire about additional discounts or ways to lower your premium based on the details provided in the quotations.

- Bundle Policies: Consider bundling multiple insurance policies, such as auto and home insurance, with the same provider to receive a discount.

- Shop Around: Don't hesitate to shop around and compare quotations from different insurance companies to find the best deal.

- Consider Increasing Deductibles: If you can afford a higher deductible, it can lower your premium and save you money in the long run.

Understanding Deductibles and Premiums

In the context of auto insurance, deductibles and premiums play a crucial role in determining the overall cost of insurance for policyholders.

Deductibles refer to the amount of money that a policyholder is required to pay out of pocket before their insurance coverage kicks in. On the other hand, premiums are the regular payments made by the policyholder to the insurance company to maintain coverage.

Impact of Deductibles on Premiums

- Higher deductibles typically result in lower premiums. This is because policyholders are taking on more financial responsibility in the event of a claim, so the insurance company can afford to charge lower premiums.

- Conversely, lower deductibles usually lead to higher premiums since the insurance company will have to cover a larger portion of the claim.

- For example, if a policyholder chooses a $500 deductible, they will likely have a higher premium compared to if they opt for a $1000 deductible.

Adjusting Deductibles for Cost Savings

- Policyholders can adjust their deductibles to find a balance between out-of-pocket costs and monthly premiums that suits their financial situation.

- By increasing the deductible amount, policyholders can enjoy lower premiums but should be prepared to pay more in case of a claim.

- Conversely, lowering the deductible will result in higher premiums but less financial burden at the time of a claim.

Last Recap

As we reach the end of our journey through Understanding Auto Insurance Quotations: The Ultimate Guide, remember that knowledge is power when it comes to making informed decisions about your coverage. Arm yourself with the insights gained here and drive confidently into the future.

FAQ

What factors can influence my auto insurance quotation?

Insurance companies consider factors like age, driving record, location, vehicle make/model, and usage when calculating your quotation.

How do deductibles and premiums impact insurance costs?

Deductibles are the amount you pay out of pocket before your insurance kicks in, while premiums are the regular payments you make. Adjusting deductibles can impact your premiums and overall insurance costs.